Utilization of Installed Base Planning for Service Parts Optimization

Organizations delivering service live and die by their ability to have parts available for field service technicians to meet contractually obligated Service Level Agreements (SLAs). To be able to do so in a cost-effective manner is the thankless task of the Service Supply Chain team. On one side, service delivery management is focused on on-time material availability to improve field engineer efficiency and minimize return trips. On the other side, the finance organization is concerned with total inventory value, excess and obsolescence. The Service Supply Chain team’s struggle is to serve both masters. By incorporating installed base information into the planning process, not only can that balance be achieved but the inventory manager can provide concrete rationale for the inventory plan.

Installed base planning for service parts is the concept of utilizing service contracts or other similar data to generate a demand forecast at an appropriate stocking location and to calculate target stock levels in order to cost-effectively support that installed base. Utilizing installed base planning is an improvement over demand history based forecasting. It can be particularly advantageous with low to no demand volumes common in service parts planning operations. The key data elements of a service contract or installed base record necessary for generating a forecast and calculating a target stock level (TSL) are:

- Part/product under contract

- Quantity of part/product under contract

- Physical location of installed base (city, state/country, postal code)

- Start/end dates (optional)

- Service response requirement – scheduled next business day, reactive same business day (ie. 4 hour), etc.

Find out for yourself how Baxter can optimize your service supply chain inventory.

Complete this form and we’ll get in contact with you or email us at info@baxterplanning.com / call us at +1 (512) 323 5959 .

Mapping the Installed Base to a Network Stocking Location

Determining where to stock service inventory to support an installed base starts with determining where to create forecasts. Postal codes are utilized to determine the appropriate stocking location at which we must forecast material to support the contract. Often times, this will be the closest physical stocking location if the contract requires same day parts availability. However, forecasting for next day scheduled requirements might be done at a region or country hub to allow for forecast consolidation; which supports risk pooling of inventory when TSLs are calculated.

Field Replaceable Units (FRU)

Service parts are commonly referred to as Field Replaceable Unit (FRU). A forecast must be generated for each FRU that is to be stocked in the field for dispatch to the service call. If the service contract data is already at the FRU level, no further processing is required to derive the part to be forecasted. However, if the service contract is written at the product level, service Bill of Materials (BOM) may be required to logically link from the product level on the contract to the FRU level that needs to be forecasted and stocked. A service BOM should contain each FRU associated with the product as well as the associated quantity. For products that may have a high degree of configurability, it is advantageous to allow the quantity to be stated as a fraction. For example, if half of a particular product ships with diskdrive A and half with disk drive B, both A and B can be included on the BOM with a quantity of .5 each.

Generating the Forecast

Once it is understood what is to be supported in the field, FRU and quantity, and where we need to plan to stock material to support the service contract, the historical demand must be incorporated into the data set in order to generate the actual material forecast. This is done by calculating a forecast rate; the projected monthly demand quantity per contract for each individual FRU. The forecast rate is derived as the ratio of historical usage and installed base using regional or global data. Global demand history and installed base data should be used if it is complete and accurate; a regional or global calculation may be called for if the demand patterns are significantly different from one region to another.

Following is an example of how historical demand (failures) and Installed Base data is used to calculate the forecast:

- From Installed Base data: Total of FRU supported in region (or globally) at close of last period = 100

- From demand history: Total demand in region for FRU in last 12 months = 84

- The forecasting rate = average demand per period / total installed base (84/12)/100 = .07

The forecast rate per installed base is .07. If in the next period (e.g. Month) our data indicates that we are now supporting 32 installations through a particular stocking location, the forecast for that part/site is 32*.07 or 2.24 demand units. In a volatile environment, such as during New Production Introduction (NPI), the forecast rate may need to be constrained, or smoothed, so that it will scale up in a controlled manner. Planners must also have the ability to update or manage the forecast rate directly. It is worth noting that in an NPI environment, when there is little or no historical data available to calculate the forecast rate, utilizing data from a similar material can be a good way to capture a forecast rate, generate a forecast, and even model installed base distribution. In the absence of a similar material, an engineering failure rate or projected MTBF (mean-time between failures) may be utilized to calculate the rate.

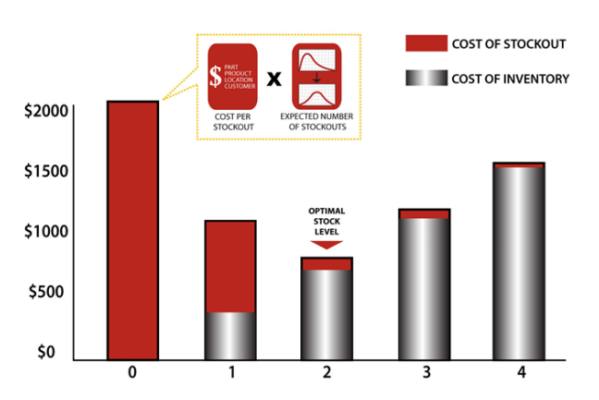

Calculating Cost Optimized Target Stock Levels

Having calculated a forecast for each part at each location using our installed base data, Bill of Materials, and historical demand, planners must now decide: what is the proper target stock level for each part at each location to support the forecasted demand? A common approach to setting the target stock level is to assign a desired service level to spread like peanut butter across the entire company or region. This methodology presupposes that all parts, products, customers and service contracts are the same; and we know they are not. Given the finite amount of cash companies have available to invest in service inventory, savvy service part planners must ensure they are buying up service level for their most critical parts, products, installations and customers while accepting a lower service level, and enjoying lower inventory investment, for non-critical parts and products. This is done by balancing the cost of positioning inventory against the cost of a stockout if material is not available when and where demand occurs (a miss). To the mantra of “Right part, right place, right time” we must add “At the right cost.” There may be times when it is more cost effective to NOT stock inventory, but this can be a dangerous decision to make if stockout costs are not considered.

When balancing the cost of inventory against the cost of a stockout, inventory cost is easy to quantify: material cost plus all associated carrying costs. Calculating the cost of a stockout is more complex.

For instance, a single point of failure (SPOF) part, the failure of which could halt an entire production line, has a higher cost of stockout than a part that has high redundancy in the system or is purely decorative in nature; ergo it is logical to stock to a higher service level on the SPOF part and take a bit more risk on the others. For a newly launched flagship product shipping to customers who will become references for future sales, management may want to invest in higher service level for all FRUs for that product vs. the FRUs for the product which is being replaced and pulled out of the field. Stockout cost for the new product is higher than for the older version.

We all agree that all customers are created equal, but some are more equal than others. A single customer which has global installations and global service support contracts probably carries a higher cost of stockout than a single customer with a single installation. Consider if there is a supplier constraint and you only have one unit of a part and a major customer and a smaller customer both need that part. Who gets it? Should it be whoever calls first? Whoever screams the loudest? Or should it be the customer that has the most cost associated with a stockout? This must be considered when determining what quantities to stock in which locations.

We must also take contract criticality into consideration. Consider service contracts that are 24 hour a day 7 day a week coverage; compare those to service contracts which require support only on business days during business hours. Stocking for the 24X7 location should normally be considered as more critical, thus carry a higher cost of stockout than an 8X5 contract.

When we bring all these parameters together – material importance, product importance, customer importance and contract criticality; and understanding which installed base are being supported from which stocking locations; a total cost optimized target stock level can be calculated for each part at each stocking location. Once the inputs to stockout cost are understood the cost of a stockout for purposes of calculating a TSL is: cost per stockout * expected number of stockouts; where the expected number of a stockout is a function of the ability to fulfill the forecasted demand with the TSL taking into account demand probability and replenishment lead times. As inventory increases, the cost per stockout is constant, but the probability of a stockout decreases.

Monitoring and Continuous Improvement

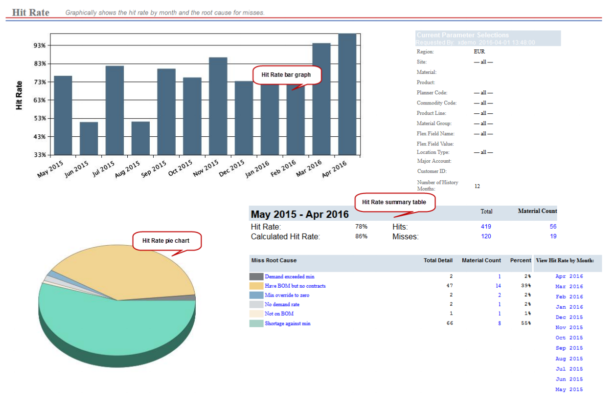

Finally, processes and tools must be in place to monitor data input and the effectiveness of the plan. The raw demand and installed base data must be reviewed prior to utilization to ensure that it is complete, consistent and accurate. If there is missing demand or installed base data, for example, the forecasting rate will not be accurate and that has a detrimental effect on all downstream calculations. Estimates may be used for some data elements while source data is improved or corrected.

Monitoring the effectiveness of your service parts material planning operation in terms of hits and misses goes much deeper than just determining if the parts were delivered to the customer on time. That may be the metric the organization shares with its customers, but it is not a detailed enough metric to measure the effectiveness and drive improvement of the planning operation. At the first cut, each successful and on time customer delivery must be analyzed to determine if it was delivered from the correct location. A service delivery that meets the SLA is good, but the part must be available from the planned location to avoid costs such as expedited transportation or field engineer productivity lost. A delivery expedited from a sub-optimal location has to be classified as a planning process miss for analysis purposes in order for the process to be improved upon.

In order to do an accurate hit rate analysis, each demand request must be reviewed to determine if the on hand balance was sufficient at the right location to cover that demand. When a demand is classified as a miss, there must be further analysis to determine the root cause of that miss in order for the appropriate corrective action to be taken. The causes of misses are many, but can be roughly categorized as

unplanned misses which may be data, material, or process driven; or planned misses.

Examples of each type of miss:

Data Driven:

- Material not on BOM

- No contract/installed base consensus

Material Driven:

- Delinquent supply order

- Part level planning constraint

Process Driven:

- TSL change not approved/effective

- Unfulfilled replenishment order

Planned miss:

- Cost of stocking inventory was greater than cost of stockout

The specific root causes are dependent on the data available to the calculation and various configuration options that are available in the planning system. To do this analysis in a timely manner – daily – while information is at its freshest and most actionable is critical, therefore a systematic way of analyzing demand data and classifying misses is a requirement. Only in the lowest volume environment imaginable could this be done manually.

With the right tools, processes and disciplines utilizing installed base data to drive demand mapping, forecasting and calculation of target stock levels, a very refined and accurate service inventory plan can be developed. Paired with a closed loop process for feedback and continuous improvement, any service parts planning organization can enjoy lower inventory levels, higher service levels, and a consistently delighted customer base.